How Mutual Fund Expense Ratios Work: Explain in Detail

Feb 27, 2024 By Triston Martin

Introduction

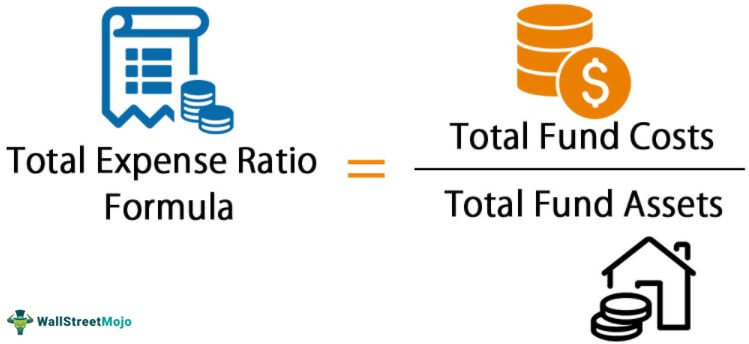

The expense ratio of a mutual fund is a crucial metric for investors to consider because operational and management expenses can significantly eat into a fund's net returns. The expense ratio of a mutual fund may be calculated by dividing the yearly fees paid by the fund (including management and operating costs) by the value of the fund's assets. There is a wide range of expenditure ratios among mutual funds. In 2020, the average expense ratio for an index fund will be 0.06%, significantly less than the 0.15% average for actively managed portfolio funds. For actively managed funds, the average expense ratio in 2020 was 0.71%, with some funds charging much more. This illustration demonstrates that mutual fund expense ratios can considerably impact investment returns over the long run.

How Does an Expense Ratio Work?

The expense ratio measures the costs associated with operating a mutual fund as a percentage of the fund's total assets. Due to higher operational costs, actively managed funds often have a higher expense ratio. Funds handled by humans, as opposed to algorithms, are called "actively managed." As a private investor, you must pay a specific proportion of your starting capital each year. For this example, let's pretend you have $10,000 in an index fund with a 0.5 percent charge ratio. A yearly average of $50 would be needed for upkeep. Expenses associated with the fund manager will not be deducted from your investment. Your earnings will be reduced if you choose to invest the money.

Why Is It Important to Understand Expense Ratios?

When you invest in a pooled fund, you pay for management expertise. You should keep track of your annual mutual fund or ETF expenses just like any other service. The expense ratio is the yearly proportion of your investment that will be paid in fees to the fund's administrator. Fees can eat away at your returns by the tens of thousands of dollars if you're investing for the long term, like retirement.

Finding a Mutual Fund's Expense Ratio

Even though it is beneficial to average spending ratios, the only way to obtain a proper perspective of a fund's operating costs is to analyze those charges individually. This is the only method to understand a fund's operating costs accurately. The expense ratio of a mutual fund can be computed using one of three different approaches.

Locate It on the Brokerage Company Website

Let's say, for instance, that you are interested in learning the price of Admiral Shares of the Vanguard 500 Index Fund. If you are a private investor visiting their website, you should look into Vanguard. To get started using this website, go to the primary search box and type the name of the investment fund that you want to use. It is essential to locate the appropriate investment vehicle. The annual expenses come to 0.04% of the fund's total value and can be found on the summary page of the fund, which can be reached by following the link provided.

Look It Up Using the Fund's Ticker Symbol

A mutual fund's "ticker symbol" is its distinctive identifier; it consists of five characters. For example, "VFIAX" is the ticker symbol for the Admiral Shares of the Vanguard 500 Index Fund. If you look for the symbol on Google, you should be able to find a market summary at the very top of the page that displays the results of your search. Check to see what percentage of your donation goes toward funding administrative costs associated with the fund.

Find It in the Fund's Prospectus

Investors get an annual brochure outlining the fund's strategy and results, also available online. Any interested parties can obtain a copy of a specific mutual fund prospectus by visiting the company's website. In the table of contents, look for "Fees and Expenses" to learn the fund's expense ratio. Some fund prospectuses provide a gross and net ratio for expenses. The gross expense ratio is the overall cost of running the fund as a proportion of total assets. This includes operating costs, interest payments, and any management fees. The net expense ratio is the total cost ratio after all discounts and reimbursements have been applied. The net expense ratio captures the actual cost of running a mutual fund.

Conclusion

Many traders overpay for their assets without realizing it. The expense ratio fees negatively impact investors' returns, so they should be avoided at all costs. Therefore, a wise investor who wants to maximize returns should prioritize locating mutual funds with low fee ratios. Profits can be eroded by a variety of fees in addition to operational costs. When evaluating potential returns from various mutual funds, it's essential to consider how taxes on withdrawals can cut into those returns. Using this technique, you may calculate a reasonable approximation of the actual return of any mutual fund.

Stated Value Car Insurance

Uncovering the Best Alternatives to Edgewonk: Elevate Your Trading Game

Marqeta’s Processing Volume Hits $71 Billion

Virginia First Time Home Buyer

Deciphering Financial Choices: Cash Management Account vs. Money Market Fund

Benefits of LensCrafters Credit Card – The Ultimate Review

When Should I Refinance My Auto Loan?

Review of the Starbucks Rewards Visa Card for 2022

How to Buy Stocks Step by Step: A Comprehensive Guide to Investing